Understanding How to Monetize Virtual Funds in Crypto Trading

The world of cryptocurrency is rapidly evolving, offering unprecedented opportunities for investment and profit. As individuals and businesses alike navigate this new financial landscape, the ability to monetize virtual funds has become a crucial skill. This detailed guide will dive deep into the mechanics of crypto trading, exploring strategies and tools that you can use to enhance your financial journey.

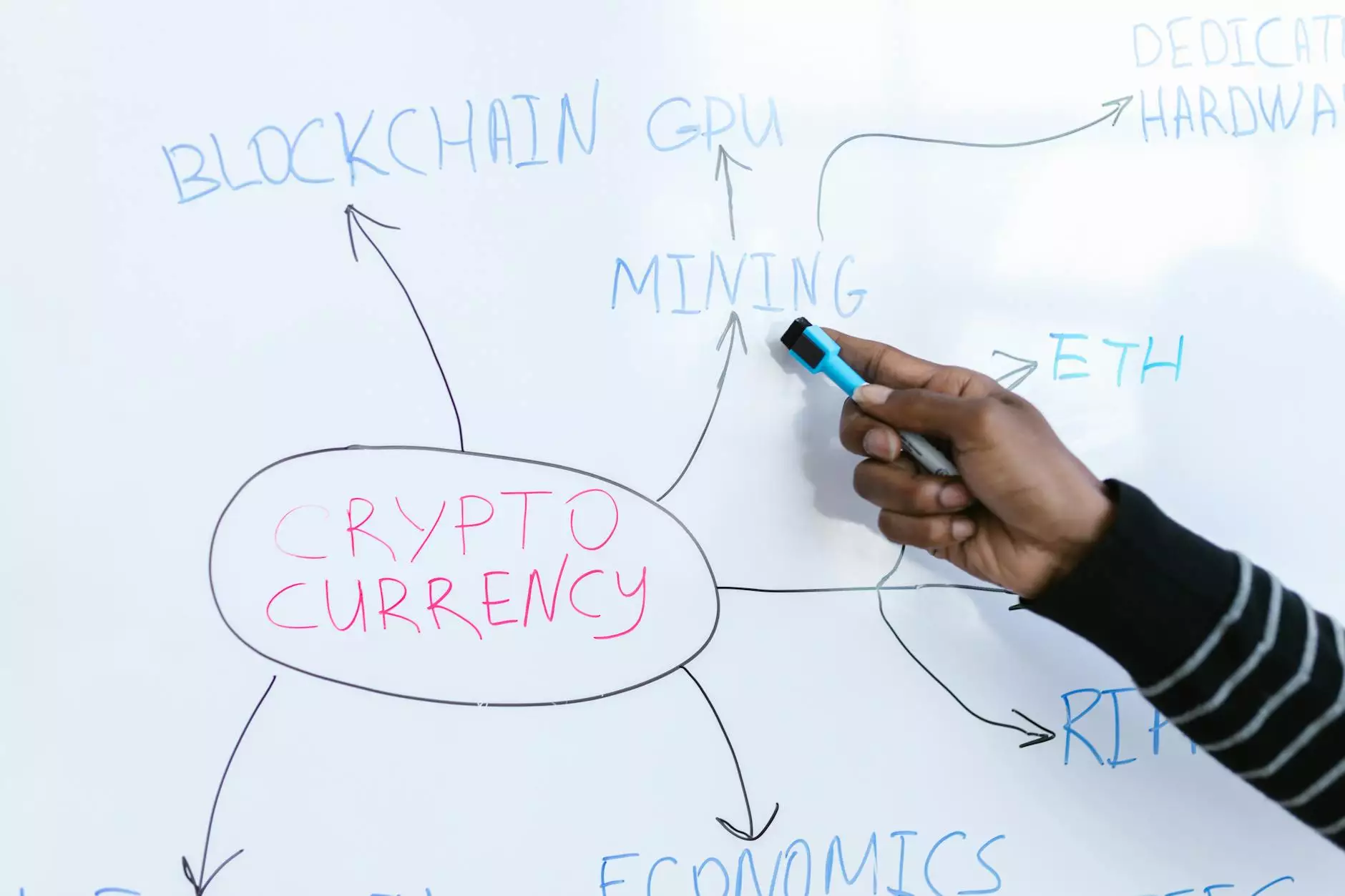

The Basics of Cryptocurrency

Before diving into tactics for monetization, it's essential to understand what cryptocurrency is. Cryptocurrencies are decentralized digital currencies powered by blockchain technology. The most famous example is Bitcoin, but thousands of alternative coins (or altcoins) exist, each with unique features.

- Decentralization: Unlike traditional currencies, cryptocurrencies are not controlled by any central authority, making them immune to government interference or manipulation.

- Blockchain Technology: The underlying tech that ensures transparency, security, and immutability of transaction records.

- Variety of Coins: From Bitcoin and Ethereum to emerging altcoins, the diverse range of assets allows for tailored investment strategies.

Why Monetize Virtual Funds?

The primary reason behind the push to monetize virtual funds is profit maximization. Here are a few compelling benefits:

- Investment Growth: Investing in cryptocurrencies can offer substantial returns, far exceeding traditional investments.

- Diversification: Including cryptocurrencies in your investment portfolio can reduce overall risk.

- Accessibility: With the advent of mobile wallets and trading apps, anyone with an internet connection can participate in crypto trading.

Strategies to Effectively Monetize Virtual Funds

To succeed in the cryptocurrency space, one must employ effective strategies. Here are several key approaches:

1. Cryptocurrency Trading

Active trading involves buying and selling cryptocurrencies in order to profit from market fluctuations. Here are a few trading strategies:

- Day Trading: This involves making multiple trades throughout the day to capitalize on short-term price movements.

- Swing Trading: Traders hold onto assets for a period (usually days to weeks) to profit from expected price changes.

- Scalping: A strategy where traders make small profits on minor price changes, often utilizing high trade volumes.

2. HODLing

The term "HODL" originated from a misspelled forum post and refers to holding onto cryptocurrencies rather than trading them. This strategy is based on the belief that the price of a coin will rise significantly over time.

- Research Strong Assets: Focus on coins with solid fundamentals and long-term viability.

- Be Patient: Hold through market volatility, believing in the long-term potential of your investments.

3. Staking and Yield Farming

These are methods of earning passive income from your cryptocurrency holdings:

- Staking: Involves locking up your coins to support the network's operations in return for rewards.

- Yield Farming: This involves lending your assets to others through smart contracts in exchange for interest or additional tokens.

Tools to Help You Monetize Virtual Funds

Several tools can streamline the process of monetizing virtual funds. Here’s a look at some of the most essential:

1. Cryptocurrency Exchanges

Exchanges are platforms where you can buy, sell, or trade cryptocurrencies. Popular exchanges include:

- Binance: Known for its wide variety of coins and advanced trading features.

- Coinbase: Ideal for beginners due to its user-friendly interface.

- Kraken: Offers advanced trading tools suitable for experienced traders.

2. Wallets

To store your cryptocurrencies securely, you need a wallet. There are two main types of wallets:

- Hot Wallets: These are connected to the internet, making them more convenient but also more vulnerable to hacks.

- Cold Wallets: These are offline storage methods, such as hardware wallets, providing better security for large amounts of cryptocurrency.

3. Market Analysis Tools

Utilizing analytical tools can enhance your trading strategies. Look for:

- Charting Software: Tools like TradingView help track price movements and identify trends.

- News Aggregators: Stay updated with crypto news, such as CoinDesk or CoinTelegraph, to inform your investment decisions.

Understanding the Risks of Monetizing Virtual Funds

While the potential rewards in cryptocurrency trading can be significant, it's essential to understand the risks involved:

- Market Volatility: Cryptocurrency prices can soar or plummet in a matter of hours based on market sentiment.

- Regulatory Risks: Changes in legislation can impact the value and legality of certain cryptocurrencies.

- Security Risks: Hacks and scams are prevalent in the crypto space; safeguarding your assets is critical.

Conclusion: The Future of Monetizing Virtual Funds

The landscape of cryptocurrency trading offers a unique opportunity to monetize virtual funds in a growing digital economy. By understanding the fundamentals, employing effective strategies, leveraging the right tools, and acknowledging the inherent risks, you can position yourself for successful investments in the future.

As this exciting market continues to evolve, staying educated and adaptive will remain essential. The crypto trading environment is not just a phase; it's a new financial reality. Equip yourself with knowledge and proactively manage your assets to maximize your monetization potential.